Are you struggling with old debt that seems to follow you everywhere? You might be surprised to learn that in South Africa, some debts have an expiration date. This legal concept, known as prescription, could be your path to financial freedom.

What is Prescription?

Prescription is a legal principle that puts a time limit on how long creditors can legally pursue you for a debt. Think of it as a statute of limitations for your financial obligations. Once this period passes without certain activities, the debt becomes "prescribed" – meaning you're no longer legally obligated to pay it.

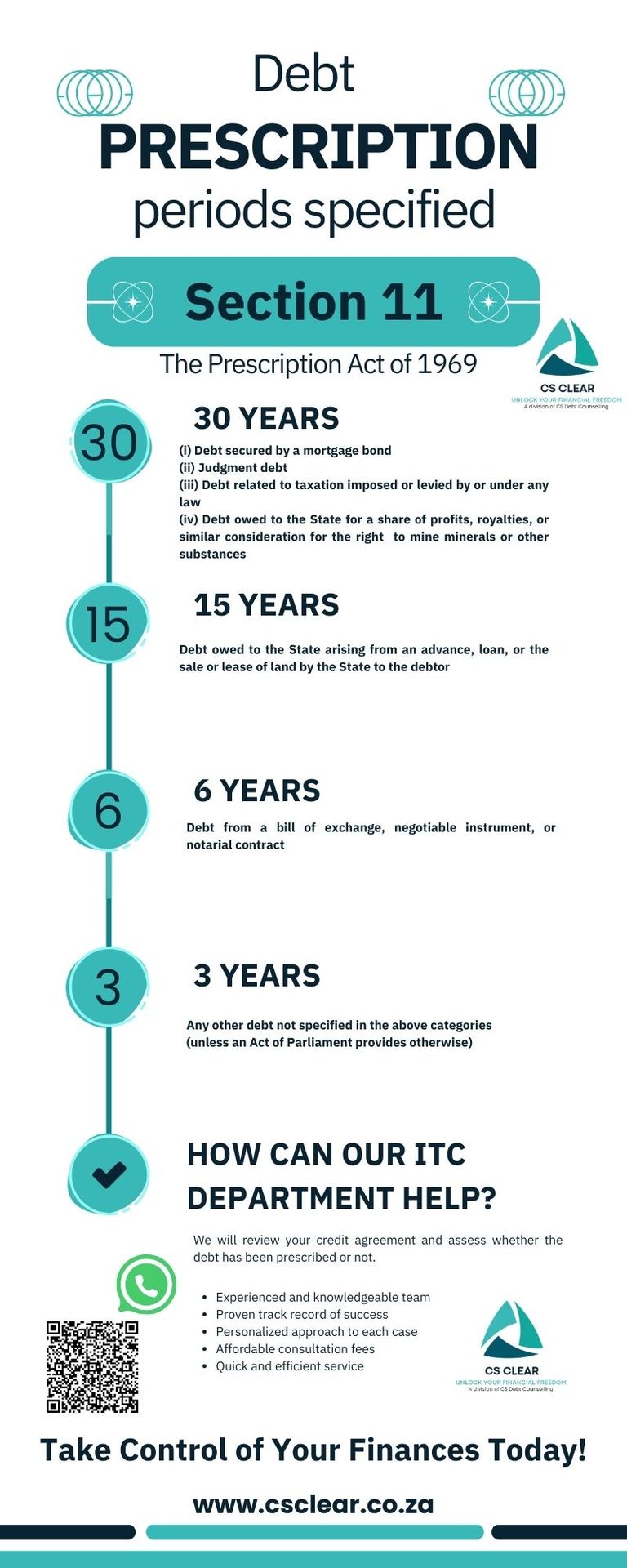

This consumer protection mechanism is governed by the Prescription Act of 1969 and supported by the National Credit Act (NCA). It exists to prevent South Africans from being burdened by old, unresolved debts forever.

How Long Can Creditors Chase You for Debt?

For most consumer debts in South Africa, the prescription period is 3 years. This includes:

- Credit cards

- Personal loans

- Store accounts

- Cellphone contracts

- Overdrafts

However, not all debts follow this 3-year rule. Important exceptions include:

- Home loans and mortgage bonds → 30 years

- Court judgments and fines → 30 years

- Municipal rates and taxes → Special rules apply

The clock starts ticking from the date of your last payment or when you last acknowledged the debt in some way.

Real-Life Prescription Examples

Example 1: Sarah took out a personal loan in 2020. She made her last payment in January 2022 and hasn't communicated with the lender since. By January 2025, this debt would become prescribed if no legal action was taken against her.

Example 2: Thabo has an ABC credit card debt from 2021. He made his last payment in March 2022. In April 2023, he received a summons from the bank. Because the summons was served before the 3-year period expired, the debt will not prescribe.

Example 3: Lerato has a clothing store account she stopped paying in February 2020. The store called her in December 2022, and she verbally promised to pay. This acknowledgment reset the 3-year prescription period, meaning the debt now wouldn't prescribe until December 2025.

What Stops the Prescription Clock?

Take note of these actions that can interrupt or reset the prescription period:

- Making any payment, even a small amount

- Acknowledging the debt in writing, over the phone, or via email

- Being served with a court summons (note: the summons must be properly served, not just issued)

Creditors often use these tactics to keep debts active, so think carefully before engaging with collectors about old debts.

How to Prove Your Debt Has Prescribed

If you believe your debt has prescribed, here's how to handle it:

- Gather evidence of when your last payment was made (bank statements, receipts)

- Check for any communication where you may have acknowledged the debt

- Verify if any summons was properly served within the prescription period

- Send a formal letter to the creditor stating that the debt has prescribed (template available on request)

- Keep all records of your correspondence

Remember: You don't need to "apply" for prescription – it happens automatically by law once the time period passes without interruption.

Prescribed Debt and Your Credit Report

Even after a debt becomes prescribed—meaning it’s no longer legally enforceable—it might linger on your credit report for up to five years from your last payment date.

If you spot a prescribed debt still dragging down your credit score, here’s what you can do:

- File a dispute directly with the credit bureau to challenge the listing.

- Lodge a complaint with the NCR if you’re not getting anywhere.

- Reach out to a trusted credit clearing service for some expert help.

Try Our Prescription Calculator

To determine if your debt has prescribed:

Wondering if your debt might have prescribed? Use our Prescription Calculator to get an estimate:

Try Our Prescription Calculator

Curious about your debt?

Note: This tool provides an estimate. For expert advice, contact CS Clear.

FAQs About Prescribed Debt

How do I remove prescribed debt from my credit report? Contact the credit bureaus directly with evidence of prescription, or engage a credit clearing service to assist with the dispute process.

Can the National Credit Regulator (NCR) help with prescribed debt? Yes, the NCR can assist if creditors are violating your rights by pursuing prescribed debt. You can file a complaint through their website.

Does all other banks handle prescribed debt differently? All financial institutions must follow the same legal framework regarding prescription, though their collection practices may differ.

Can I get a prescribed debt letter template? Yes, we can provide a template for formally notifying creditors about prescribed debt. Contact us for assistance.

How long does prescribed debt stay on my credit report? Generally up to 5 years from the date of your last payment.

Take Control of Your Financial Future

Prescription offers a legal way to move forward from old debts that have been hanging over your head. If you're struggling with debt collectors pursuing you for potentially prescribed debts, know your rights and be careful not to accidentally revive old obligations.

Need professional assistance navigating the complexities of debt prescription? Our team is here to help you understand your options and take steps toward financial freedom.

Contact us today for a confidential consultation about your specific situation!